Ace Tips About How To Become An Accredited Investor

If you plan to handle other’s funds, set up a custodian.

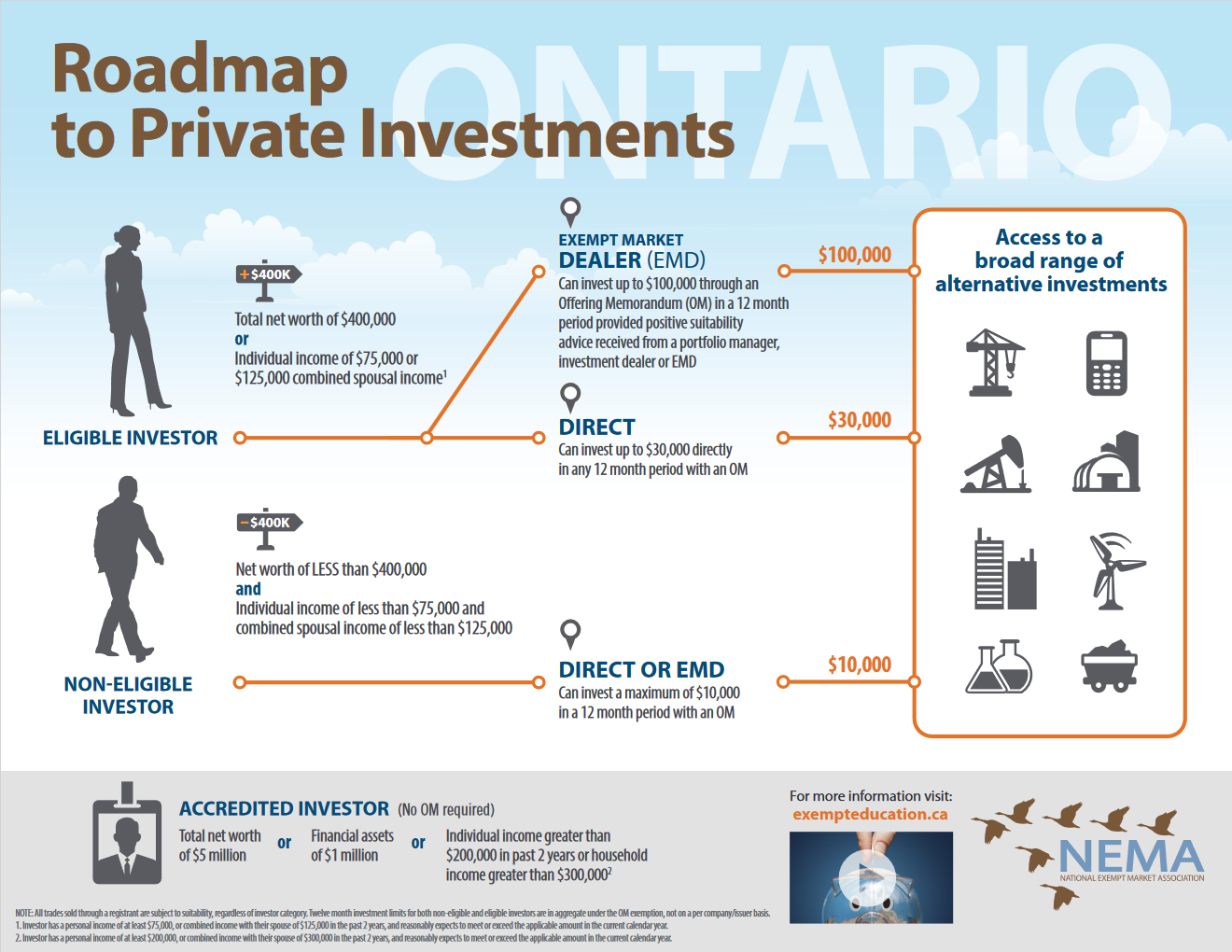

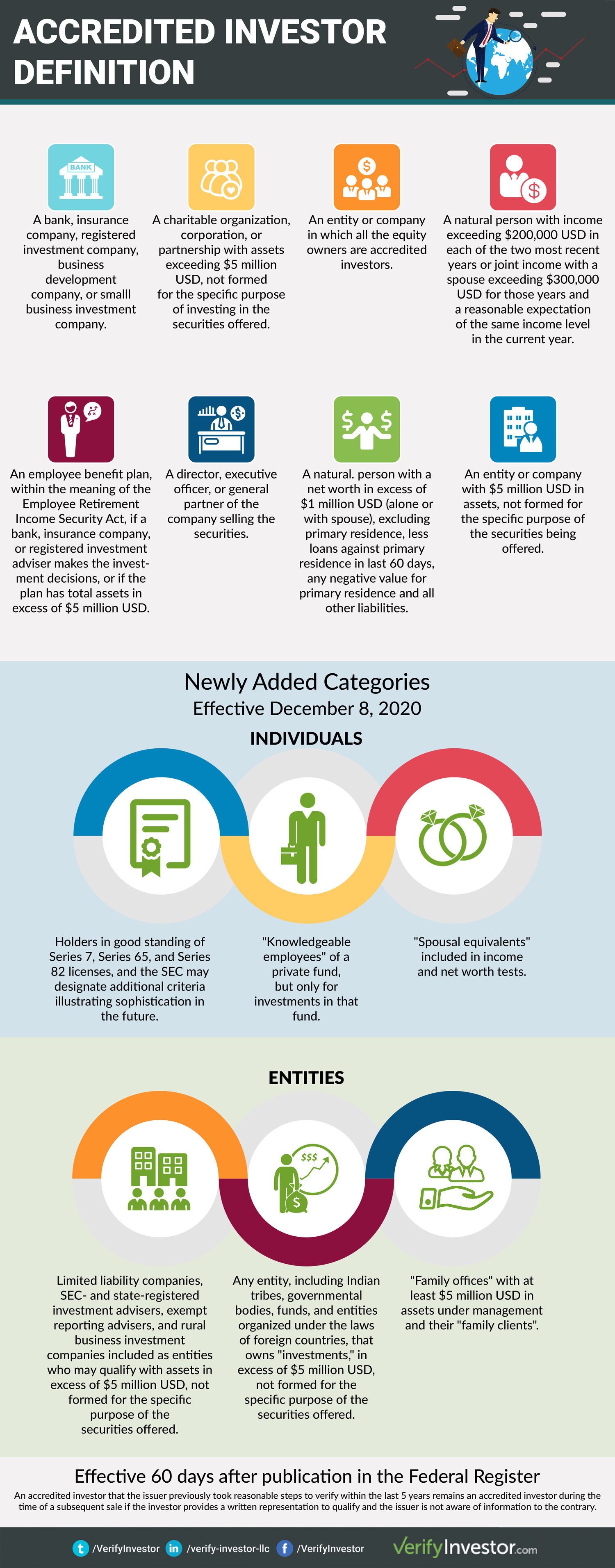

How to become an accredited investor. Recently, a new bill was introduced that would make becoming an accredited investor even easier: Current farmland investment opportunities | acretrader investment offerings acretrader employs a thorough review process that eliminates the vast majority of the parcels we evaluate. An accredited investor is an individual or a business entity that is allowed to trade unregistered securities.

Incorporate your business. There must also be a reasonable expectation that they will earn the same or more in the current calendar year and the coming year. Digital world shares rose 16% to $50.49 in afternoon trading in new york on thursday.

You can determine if you qualify by. The sec defines an accredited investor as someone who meets one of following three requirements: To qualify as an accredited investor, you must meet one of two financial criteria:

To claim accredited investor status, you must meet at least one of the following requirements: An accredited investor is any firm or individual that enjoys access to those securities which are not registered with the united states securities and exchange commission (sec) and hence, are not available to normal traders. To apply under that option, you’ll have to pull together documentation of all your.

Has an annual income of at least $200,000, or $300,000 if combined with a spouse’s income. However, an investor must fulfill certain criteria to become one. If it passes, the sec will create a new exam anyone can take specifically to become an accredited investor.

An accredited investor is a person or entity that is allowed to invest in securities that are not. Understanding the path to becoming an accredited investor is crucial because it involves specific financial criteria. An annual income of $200,000 or more for the two most recent years (and sustainable into the future) for a single investor, or $300,000 for a married couple.

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings. An accredited investor is a person or institution that meets certain requirements to purchase an investment reserved for sophisticated investors. To become an accredited investor, you’ll need to have made more than $200,000 in each of the past 2 years, and be able to show that on your tax returns.

The requirements to become an accredited investor can be met through one’s income, net worth, or line of work. Qualifying as an accredited investor requires proof of assets and income. Advertisement an individual or joint net worth in excess of $1 million,.

To become accredited certain criteria. Register yourself as an investment adviser representative (iar) of the firm. Hold (in good standing) a series 7, 65 or 82 license have a net worth exceeding $1 million individually or combined with a spouse or spousal equivalent (excluding the value of the primary residence)

Qualifying as an accredited investor is a process that takes place between a company or financial institution that’s selling an unregistered investment asset and the buyer of the investment. How do you qualify as an accredited investor? But what does it take to achieve accredited investor status?