Outrageous Tips About How To Claim Student Loans On Tax Return

You paid interest on a qualified.

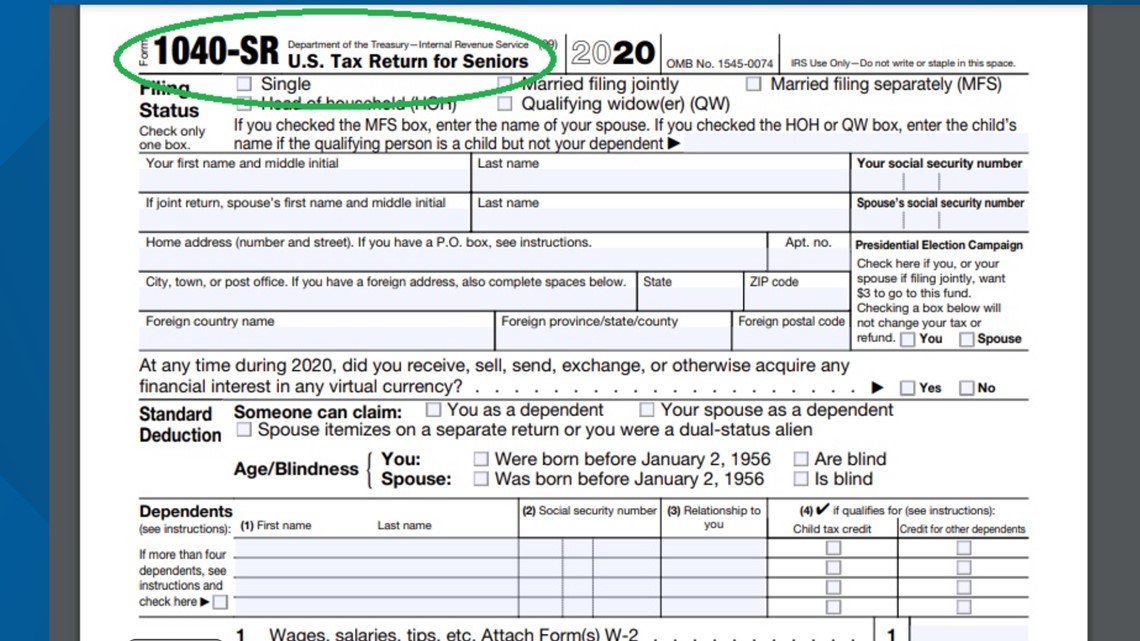

How to claim student loans on tax return. You paid interest on a qualified student loan in tax year 2023; This is your federal tax return. For 2023, you can contribute up to $6,500 ($7,000 in 2024) a year to your roth individual retirement account (ira) or $7,500 ($8,000 in 2024) if you’re age 50 or older.

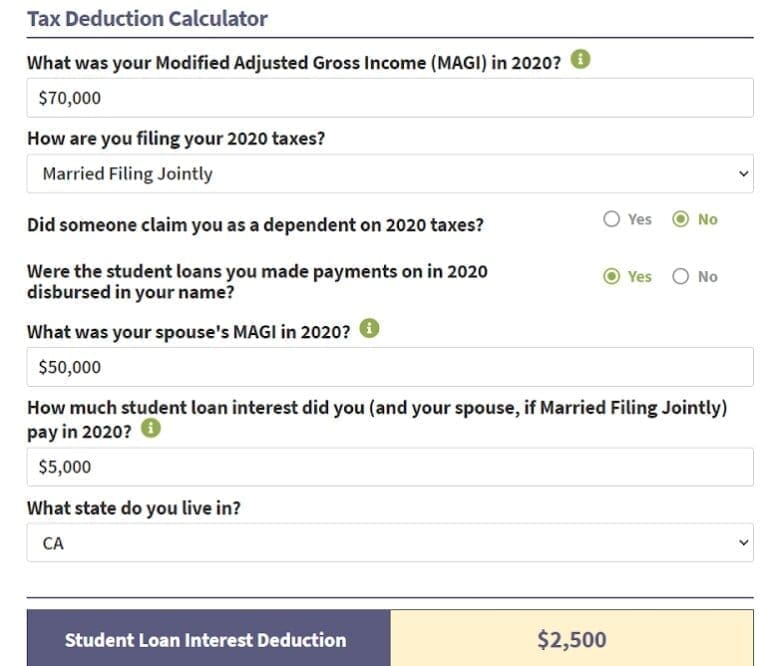

In figuring the amount of either education credit (american opportunity or lifetime learning), joan must reduce the qualified education expenses by the amount of the scholarship. H&r block’s online tax product is free only if you meet h&r block’s definition of a “simple return,” a tax situation that the ftc says many people think they have, but. The student loan interest deduction allows you to deduct up to $2,500 from your taxes.

You can claim the deduction if all of the following apply: Are student loans tax deductible in canada? Borrowers who had their federal student loans forgiven last year won't pay federal taxes.

This is your federal tax return. According to irs figures, there were 344,000 such claims in the bluegrass state that tax year, with the average credit payout at about $2,500. If you have student loans or pay education costs for yourself, you may be eligible to claim education deductions and credits on your tax return, such as loan.

It allows you to deduct the interest on student loans that you've paid during the tax year. You can deduct all or a portion of your student loan interest if you meet all of the following requirements: The median reduction under the paye or ibr plans is $56 per month for one.

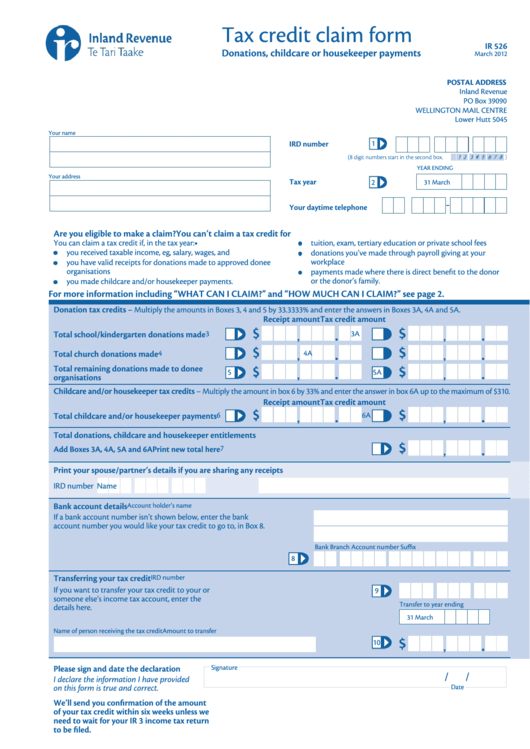

Enter the eligible amount of interest paid on your student loans on line 31900 of your. If you made federal student loan payments in 2023, you may be eligible to deduct a portion of the interest paid on your 2023 federal tax return. You're legally obligated to pay interest on a.

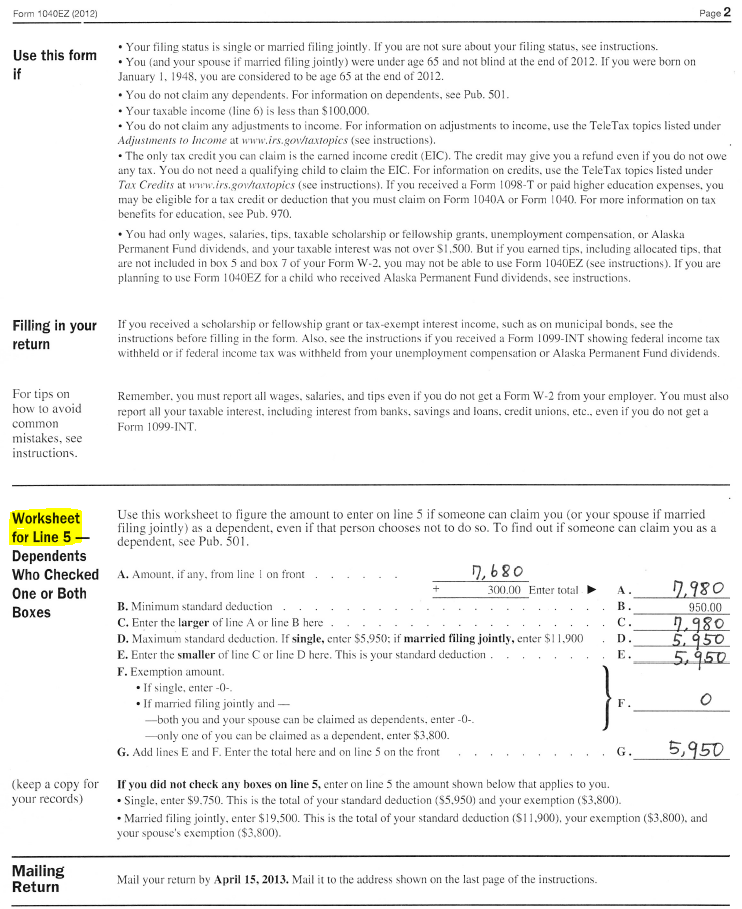

The short answer is yes. The increase in family size reduces the loan repayment amount in most cases. There are a few documents you'll need before you can claim the student loan interest deduction on your federal taxes:

Educational expenses paid with nontaxable funds. February 26, 2024, 8:11 am pst. Student loans can impact your federal income tax return in several ways, from reducing your taxable income to losing your refund, depending on your situation.

But they could owe their state. This is known as a student loan. The education department contracts with different companies to service its federal student loans, including mohela, nelnet and edfinancial, and pays them more.

How to claim your student loan payments on your 2023 taxes documents needed for claiming student loan interest deduction. You’ll receive 15% of your interest paid back as a tax credit. The largest amount you can claim for a student loan interest deductible is $2,500 for 2023 (and remains the same in 2024), but that is limited by your income.