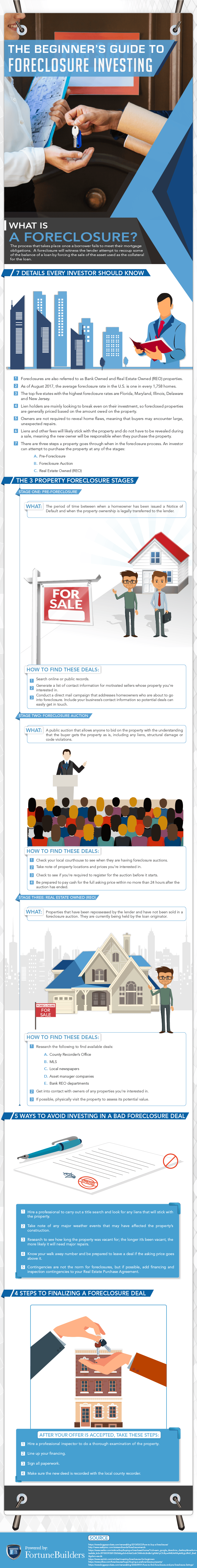

Supreme Tips About How To Deal With Foreclosure

It's about cutting a deal with your lender to stop the foreclosure process.

How to deal with foreclosure. Coping with the aftermath of a foreclosure 1. Ultimately, avoiding foreclosure starts by communicating with your mortgage lender or servicer. Check for poor locations by assessing.

When you buy a foreclosed home, there is a chance you will need to pay transfer taxes, superior liens, or taxes on the property if there are issues with the title. With a foreclosed home, it’s more important than usual to buy title insurance. There are two main ways to purchase a foreclosure:

Or you can check zillow's agent finder to find agents who have experience with foreclosures; That means the lender can repossess the property and sell it through foreclosure if the loan isn’t paid as promised. Before foreclosure, the lender may offer several alternatives.

In a short sale, the lender agrees to let you sell the property for a price in line with the market value. For borrowers facing foreclosure, there is often uncertainty about their legal rights and. In the foreclosure world, workout has nothing to do with the elliptical trainer.

Homeownership is seen as an integral part of the american dream, and the. Open the 'advanced' menu under service needed and click foreclosures in the list of specialties. Here’s how to stop foreclosure before it’s too late.

Avoid losing your home with these tips from hgtv.com. With a mortgage loan, the home or real estate backs up the loan as collateral. To find a foreclosed home, you can peruse listings of foreclosures on realtor.com®, which may also be marked as “bank owned” or “reo.” if you spot a home you like, contact the real estate.

Even if the bank or lender owns the property, this isn’t a guarantee that the title is clear of liens. From communicating with your lender early on to refinancing your mortgage, we’ll explore your options to keep your home and. Remember that you’re more than your home.

What you need to know a short sale occurs when a property is sold for less than what is owed on the mortgage with the lender's approval. Foreclosures can all seem like great deals, but that doesn't mean that they all are. How does the foreclosure process work?

At this point, the lender begins to see your property as a potential foreclosure, but it can’t legally begin the process yet. If you are unable to pay your mortgage or the value of the home has fallen below the mortgage balance, you may want to consider a short sale of the property. There are many options and resources available to help you stay in your home as well as loss mitigation options if remaining in your home is no longer feasible.

A foreclosure is a legal action mortgage lenders use to take control of a property that is in arrears. Foreclosure process step 1: Credit counselors help negotiate terms and payment plans with a debtor’s creditors.