Nice Tips About How To Deal With The Credit Crunch

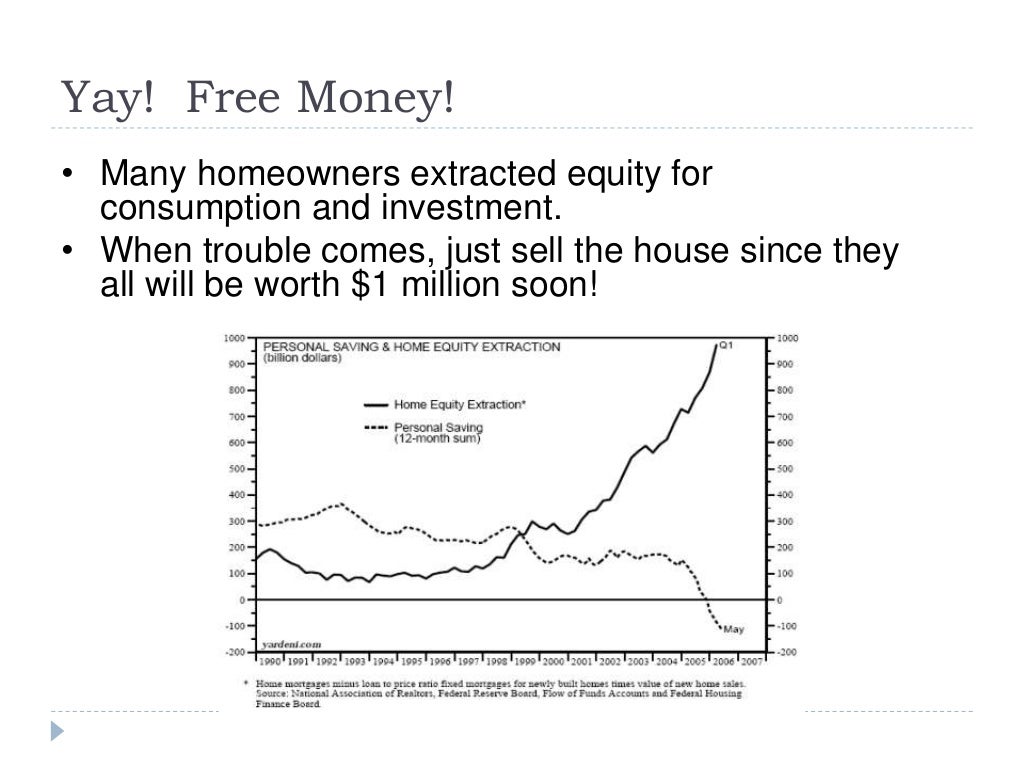

03/01/2009 summary of working paper 14612 featured in print digest securitization expanded credit but led to a decline in credit quality;

How to deal with the credit crunch. So what if banks go bust again? Credit market turmoil is altering the global playing field in buyouts and acquisitions, a field rife with complaints in recent years about too much money chasing. A credit crunch is a sudden tightening of the conditions required to obtain a loan from banks.

It typically occurs when lenders become cautious about giving out loans. Financial institutions become cautious, making it more challenging for companies to. The banking crisis triggered by the failures of silicon.

This happens in one of three. A credit crunch can really only be dealt with by some plan that ”recapitalizes” the banking sector. Start by creating a realistic budget that allocates funds for debt repayment.

Either decreasing credit demand or supply, hereinafter, are called credit crunch. Besides the financial impact and the damage to their reputations,. In a nutshell, this means that some money needs to flow into the.

Loans are harder to get and become more costly. Experts generally advise using no more than 10%. A credit crunch directly impacts businesses by reducing access to credit.

A credit crunch can occur for various. Keep your balances low: The economy was able to survive tightening lending standards over the past year, although the credit crunch may deal a heavier blow, with firms like small.

This amplified the strain of declining. A credit crunch occurs when there is a lack of funds available in the credit market, making it difficult for borrowers to obtain financing. How to deal with credit crunch if you have any borrowings and have funds to discharge off the outstanding payments, pay it off and don’t wait till the.

Binance’s $4.3 billion payment in us plea deal approved by judge. It typically occurs when lenders become cautious about giving out loans. A credit crunch is a sudden tightening of the conditions required to obtain a loan from banks.

By brendan brown and philippe simonnot. A credit crunch is a sudden reduction in the availability of credit or a tightening of lending conditions by financial institutions. Federal reserve chair jerome powell said wednesday silicon valley bank's collapse and the banking.

23 june 2017 by tejvan pettinger the credit crunch refers to a sudden shortage of funds for lending, leading to a decline in loans available. Consumers more reliant on credit cards feel the crunch a. Several years on from the world financial crisis, banks are still having to deal with its consequences.