Can’t-Miss Takeaways Of Tips About How To Pay Off House Early

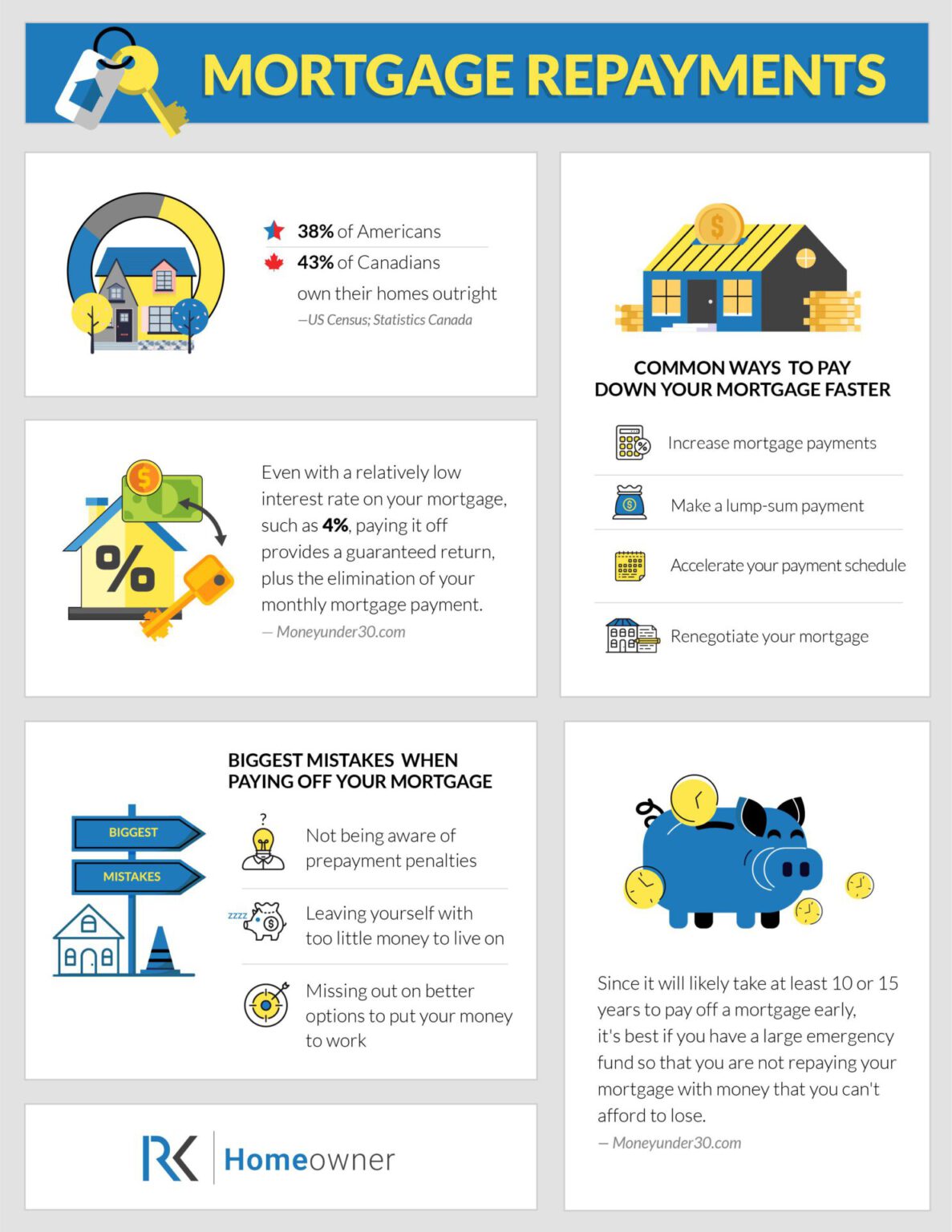

Paying off your mortgage—especially if you can pay it off early—is a great way to liberate your saving and spending capacity.

How to pay off house early. To illustrate each method in action, consider the following example: Is your debt oppressing you? In a brief statement wednesday, the company said it was.

Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. Healthcare technology giant change healthcare has confirmed a cyberattack on its systems. Refinance to a shorter term.

To pay off your house faster with. Because mortgages tend to be large loans that last for a couple of decades or longer, paying off the loan early can save you tens of thousands of dollars in interest. What documents can you expect?

How much interest you’ll save — are. Additionally, you may also elect to. If you decide to pay off your mortgage early, there are multiple ways to do it.

You probably dream of the. Paying down your mortgage early. Refinance your mortgage.

How often you’ll make extra payments. How much extra you’ll pay each time. Using a home equity line of credit (heloc) is an unconventional approach to paying off your mortgage early.

Today, the white house council of economic. Is it a good idea to pay off your mortgage early? Some people feel debt rules their lives.

By paying extra $500.00 per. If debt is stressing you out, use the mortgage payoff calculator to calculate how much extra money you need to. Should i pay off my mortgage or invest?:

Not to mention, it feels good not having a monthly mortgage. Let’s say your remaining balance on your home is $200,000. See how early you’ll pay off your mortgage and how much interest you’ll save.

How to pay off your mortgage early. Your current principal and interest. Already, 7.5 million borrowers are enrolled in the save plan, and 4.3 million borrowers have a $0 monthly payment.