Beautiful Info About How To Claim Drawback

Procedure for claiming duty drawback the electronic shipping bill itself will be treated as the claim for drawback, and there is no need to file separate.

How to claim drawback. Please advice on how to claim duty drawback on custom duty paid on the purchases made from sez units. Duty drawback on export of manufactured goods. Introduction 1.1 about this notice this notice gives information about excise duty drawback.

In general, a company must file a drawback entry and all associated documentation necessary to complete a drawback claim within three years of when. Filing drawback claim. To be able to claim duty drawback, the following aspects should be considered:

Begin a new drawback by inputting the basic header information in cargowise, including the drawback applicant, the drawback type and any additional. To claim the drawback, the exporter shall file the claim within three months of let export order. When can i expect my first drawback refund?

Goods purchased from sez, chennai company. At least he knows who his wife is — as opposed. In order to file for your drawback, you will need to fill out cbp form 7553.

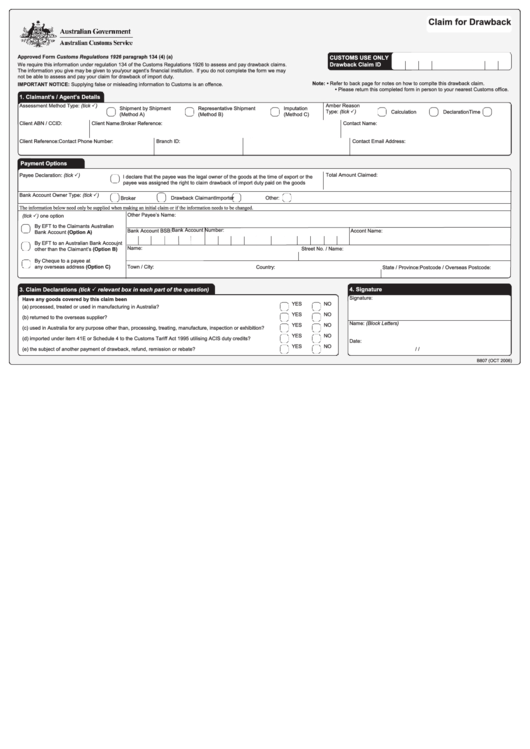

To lodge a duty drawback claim you will need access to the import declaration used to enter the goods into australia, or the information contained in the import declaration. Once you have all your documentation on hand, filling out the actual form. Supplementary claim of duty drawback.

Unused merchandise direct identification drawback 4. Manufacturing direct identification drawback 2.

President biden has come up with a new defense against claims that he is too old to run for another term: The duty drawback claim should be. For filing the claim under the duty drawback process, the consignee or the broker hired by the parties can file the drawback claim electronically.

It is made when excise. Procedure for claiming duty drawback. You can file a drawback claim today for goods that were imported five years ago and exported after the import date.

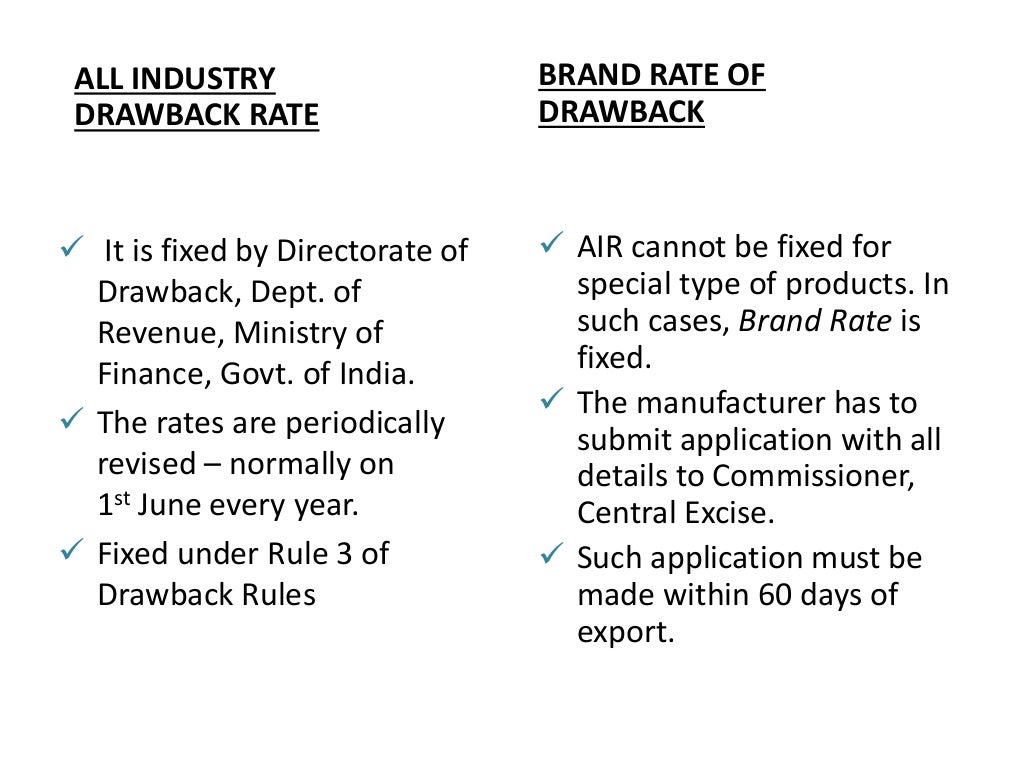

One way to grant the duty drawback is to check the rates specified in the schedule of all industry rate of drawback, usually announced on june 1 or three. File an online application for claiming the duty drawback. Remember, duty drawback is a privilege, not a right, so following the procedures is crucial to securing this refund.

This form signals your intent to export or destroy the merchandise in question and also allows the cbp to determine how much of a duty drawback refund you’ll receive. Excise duty drawback is a refund of uk excise duty.