Breathtaking Tips About How To Claim Earned Income Tax Credit

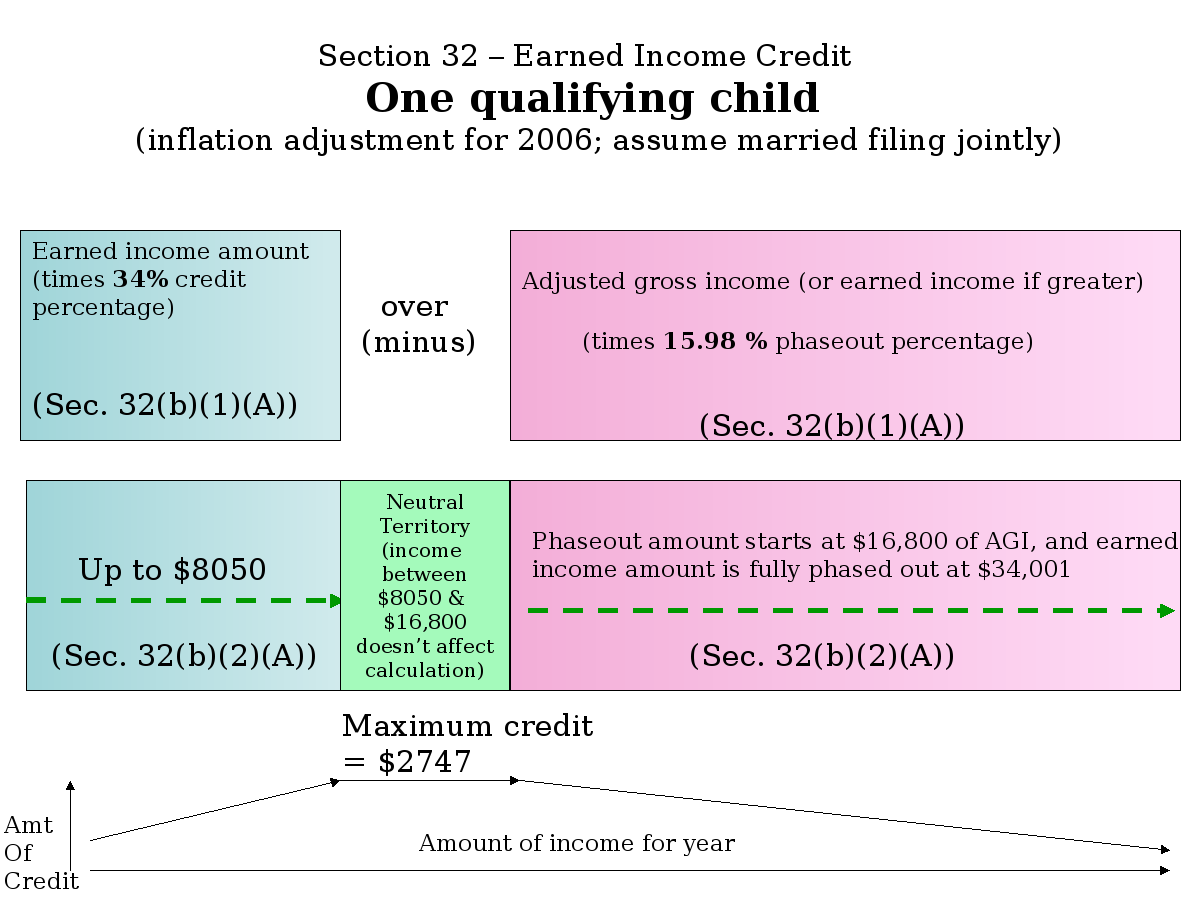

The amount of the credit depends.

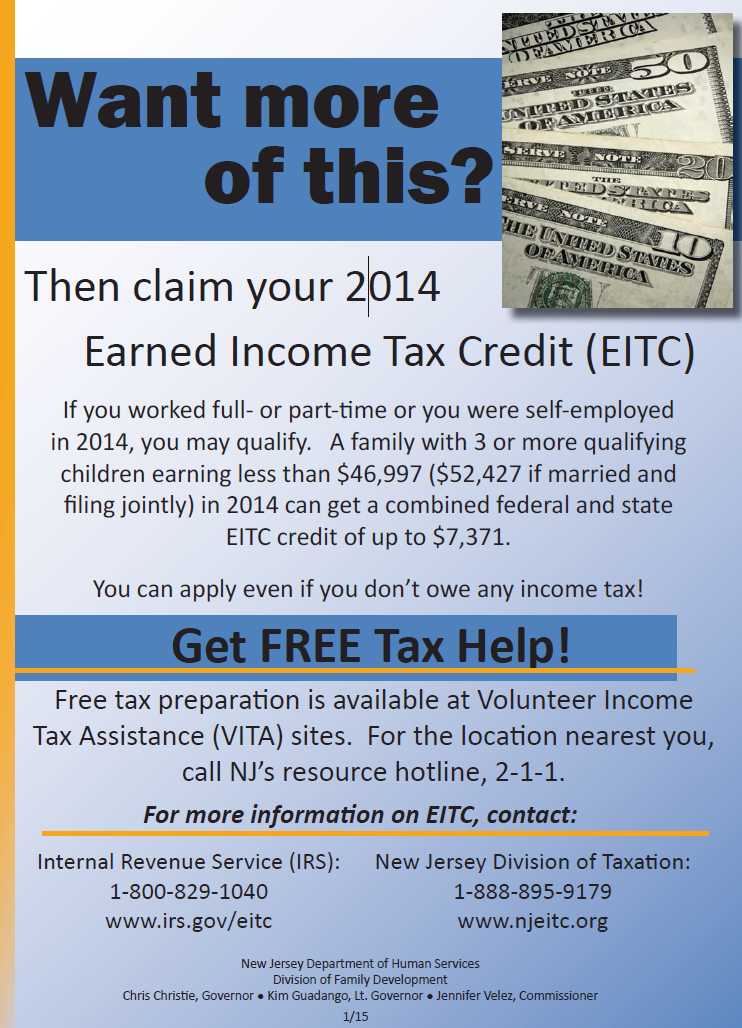

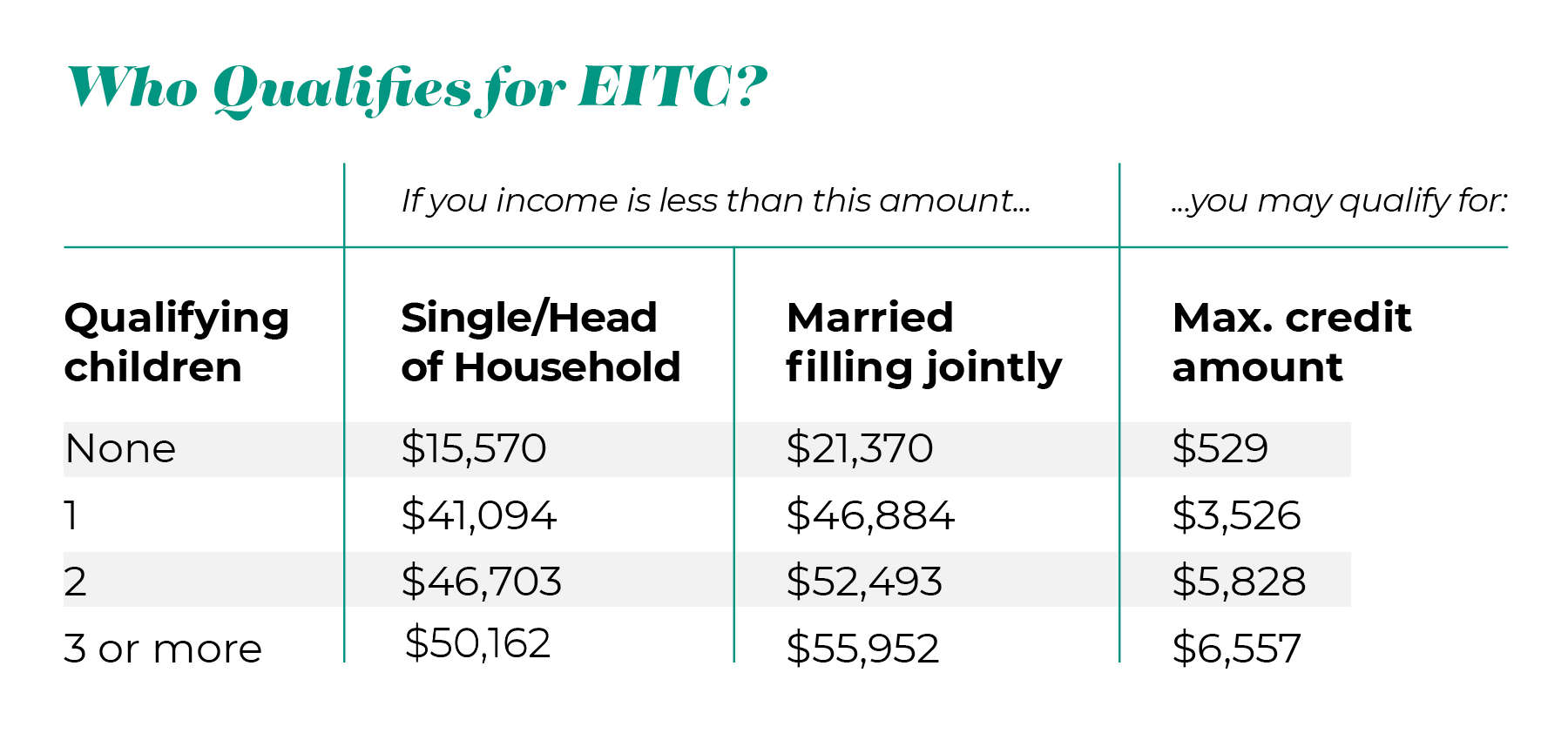

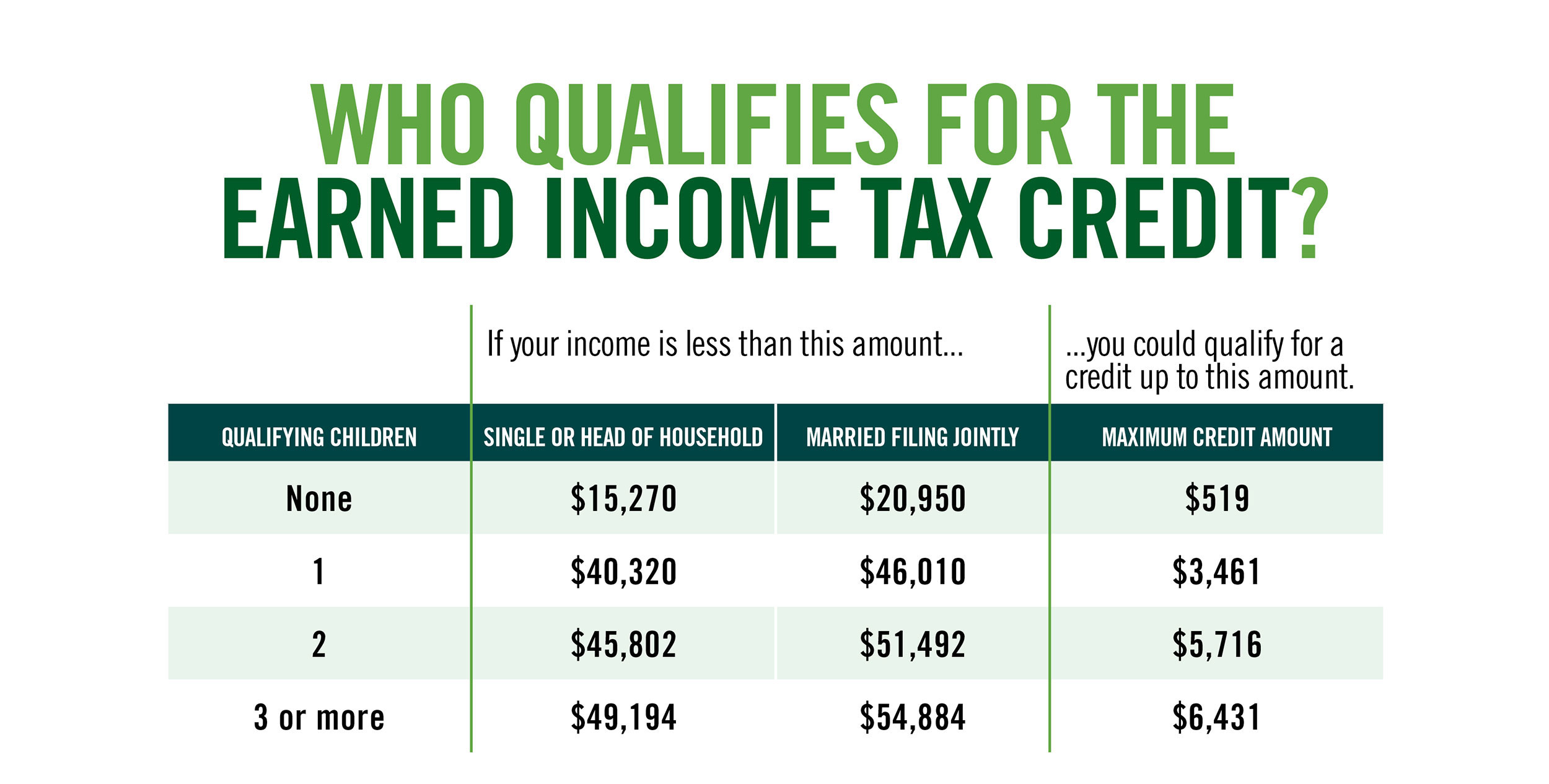

How to claim earned income tax credit. The basic qualifying rules include: Page last reviewed or updated: The earned income tax credit could be worth between $600 and $7,430 for the 2023 tax year, depending on your filing status and the.

Today, the eitc is one. We'll automatically figure out if you qualify for the earned income credit and include it in your tax return for you. Claiming the earned income tax credit the earned income tax credit (eitc) is a tax credit for people who work and whose earned income is within a certain.

Having a valid ssn (social security number) by the due date of the current tax year return. Read each one carefully to see if you qualify. You must have earned income (see section below for details).

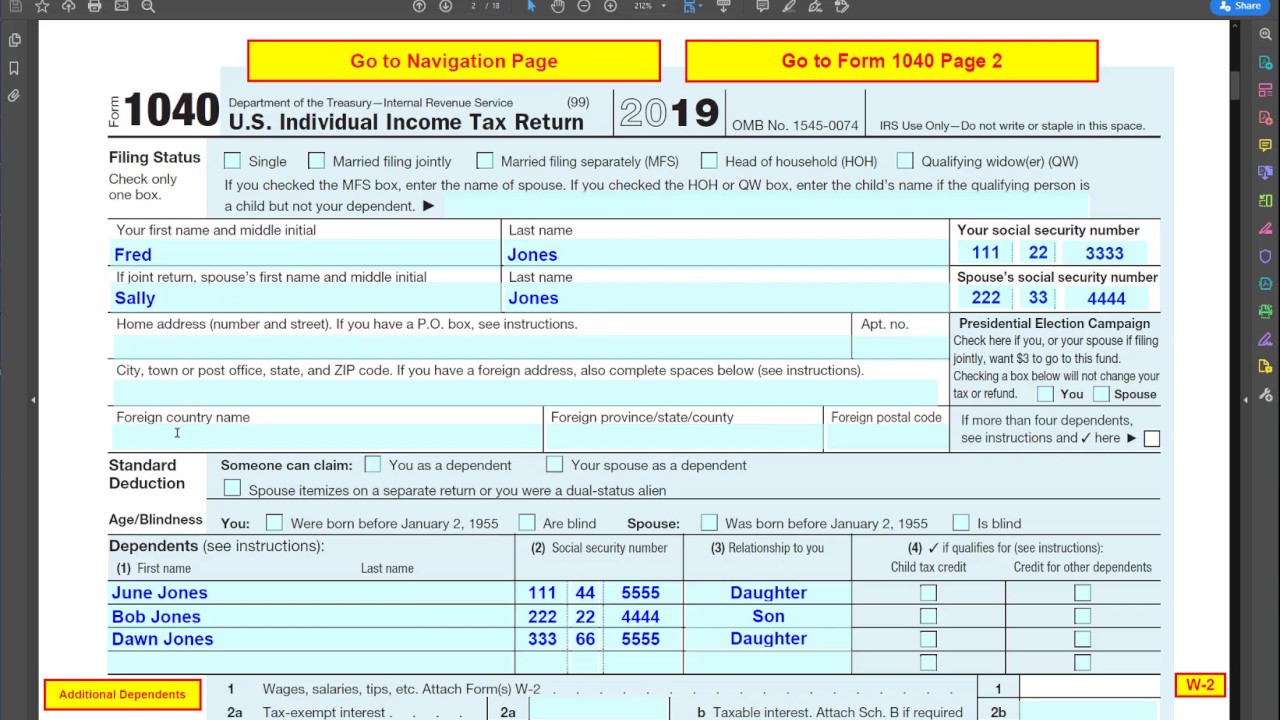

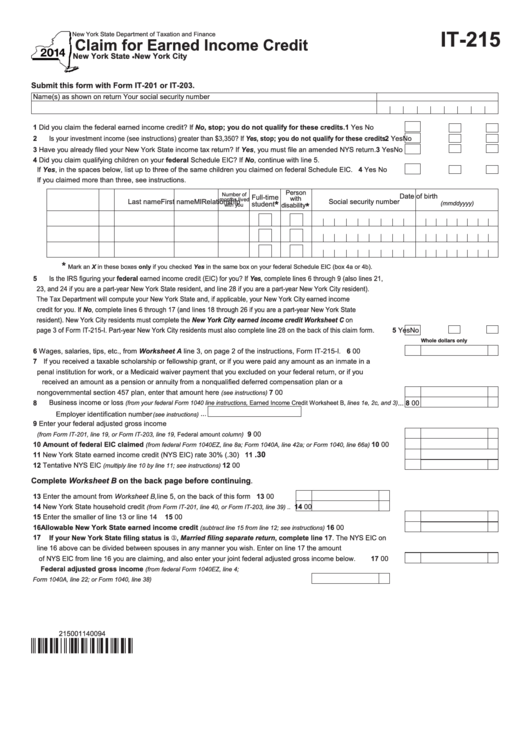

How to claim the eitc the only way to receive the eitc is by filing a tax return and claiming the credit. The maximum tax credit available per kid is $2,000 for each child under 17 on dec. If you spent $12,000, you can claim 20% of your first $10,000 in costs, or.

Key takeaways if you earned less than $63,698 (if married filing jointly) or $56,838 (if filing as an individual, surviving spouse or head of household) in tax year. Citizen for the full tax year or. Earned income credit:

As an example, if you spent $6,000 on education in 2023, you can claim 20%, or $1,200. According to irs figures, there were 344,000 such claims in the bluegrass state that tax year, with the average credit payout at about $2,500. Changes to the earned income tax credit (eitc).

Only a portion is refundable this year, up to $1,600 per child. Find if you qualify for the earned income tax credit (eitc) with or without qualifying children or relatives on your tax return. For tax year 2023, the maximum earned income tax credit is worth $7,430—that goes to a family with three or more qualifying children if you earn less than.

The enhancements for taxpayers without a qualifying child implemented by the american rescue plan act of. If you, or someone you know, might be eligible for eitc, visit the eitc assistant on irs.gov. If you claim the eitc, your refund may be delayed.

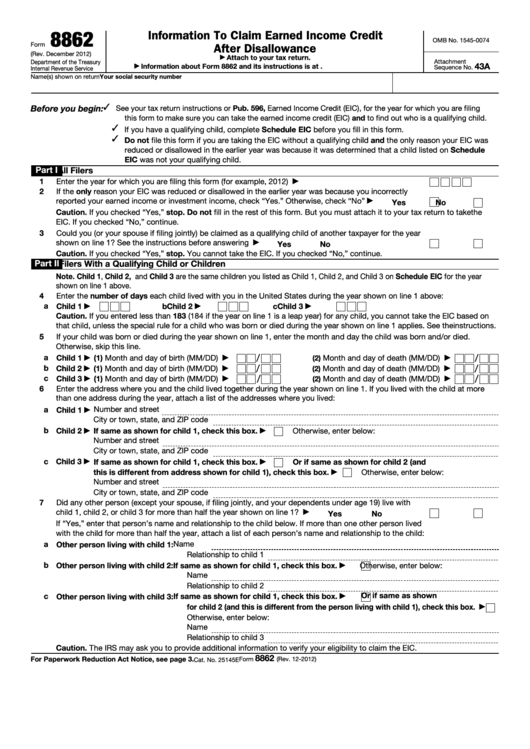

The earned income tax credit, or eitc, started out in 1975 as a plan to encourage the working poor to keep working and stay off welfare. You must file form 1040, u.s. The eitc has several qualifications.

By law, the irs cannot issue eitc and actc refunds. Where can i claim the earned income credit?